Your company cash flow is vital in keeping your business running healthily so that you can manage your outgoings with income. That’s why it’s important for businesses to manage and monitor their cash flow on a regular basis. To help businesses a cash flow forecast is the perfect tool to help predict that state of any cash held in the business, control your expenses and balance it with any predicted income.

What exactly is a cash flow forecast?

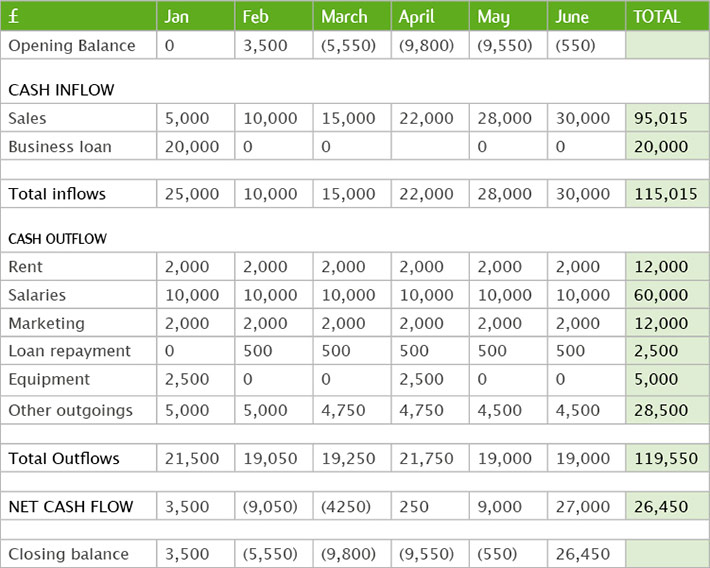

A cash flow forecast is used to calculate potential cash movement within the business over a future period. Normally, this is over a 12 month period, but they can be used for shorter or longer time periods too.

It is used to predict any cash coming into the business during the period (income) as well as cash that will be going out (expenditure).

How does this help my business?

Predicting cash flows over the course of a time period can help the business to budget and plan for the future. It can help to identify times when the business may need to rely on loans or overdrafts due to any shortfalls but it can also help to outline when the business may be profitable.

The forecast can help the business to plan for paying outgoings and monitor business performance throughout the year.

A cash flow forecast is beneficial for a business in many ways. It can;

- Help with business planning – by monitoring the movement of cash within the business, managers and business directors can have an understanding of when cash will be coming in so that they can manage expenditure.

- Identify potential shortfalls – cash moves in and out at different times, therefore, the forecast can help to predict times when a business may need a temporary cash injection from a loan or overdraft.

- Help to pay suppliers and employees – Identifying when the business will receive income can help to plan for payments of suppliers and employees, so they are paid on time.

- Identify bad credit – Businesses that invoice clients can compare client payments with their predicted cash flow to ascertain any debts or bad credit.

- Monitor performance – comparing business performance against any cash flow forecasts can help directors understand where the business is at. It can be used to find shortfalls and make improvements for the following period.

- Help obtain finance – if the business does need to invest in a loan or obtain financial aid, then most banks and lenders will require budgets, forecasts and previous expenditure.

For most businesses this tool can help them to budget and plan costs based on when money will be coming into the business. It can help to understand business performance and ensure that the company runs smoothly, even during difficult times.

Creating a cash flow forecast

Creating a cash flow forecast is relatively simple to do once you get your head around it. By utilising other financial tools such as a sales forecast and profit and loss forecast, you can easily put together your cash flow forecast.

What’s included in your forecast?

1) Predicted sales

To start your forecast you will need to look at expected sales for the time period you are covering. This can be done by looking at the last few years sales and analysing patterns of sale. It’s also important to look at the marketing and economic trends to see if they will have an impact on your business as well as seasonality, if this affects your trade.

2) Payments

For some businesses, such as retailers, payments are usually instant. But for some companies, clients pay invoices a while after they are originally sent. It’s important to factor in late payments too so that your forecast is realistic.

3) Expected outgoings

Take both your fixed and variable costs such as rent, salaries, bills, loan payments and corporation tax along with stock, commission or bonuses and materials.

When you take your cash at the start of each month, add in cash coming in, take away cash coming out, then you can have an understanding of your net cash flow as well as how much money you will have at the start and end of each month.

Direct and indirect cash flow forecasts

There are two different ways a company can prepare their cash flow forecast, known as direct and indirect cash flow forecasting. The direct method of cash flow forecasting looks at when cash is moved in and out of the business exactly, whereas the indirect method is taken from the balance sheet and profit and loss accounts.

The direct method

The direct method of predicting cash flow requires reconciling accounts to predict exactly when cash will be coming in and out of the business. It can be a much more useful tool in the short-term.

For companies that have a lot of transactions, this can be a time-consuming task but new software can help to quicken up the process. The direct method requires recording data to correctly record transactions. It provides a more detailed overview of cash flow so provides a greater degree of accuracy.

The indirect method

The indirect method utilises accounting data to predict cash flow. It can be a lot simpler for businesses to manage. In order to predict cash flow, the balance sheet is used to take away or add items that will affect cash flow.

The indirect method is more suitable for long-term planning as it can lack accuracy for shorter-term forecasts. However, it can help to predict long-term business growth so can be more suitable for analysis from within the company.

There’s no real right way to conduct your cash flow forecast, as many businesses will have different requirements. What’s important is that you monitor costs so that you can keep the business running smoothly, particularly during times of financial shortfalls. Business managers and directors can use cash flow forecasts to help plan their spending and have a greater understanding of business performance over time.